By Yash Choudhary (ASC Solicitors and Advocates)

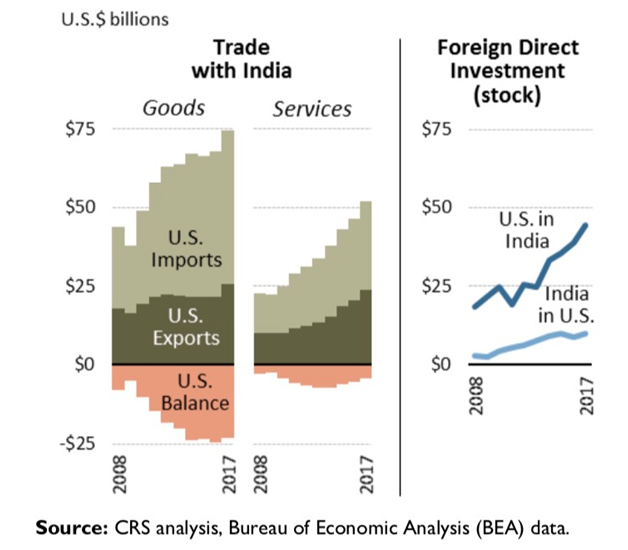

The United States and India sight one another as significant strategic partners to advance common interests regionally and globally. Bilateral trade in goods and services is 2% of U.S. world trade, and has grown in recent years.

The trade relationship is more ensuing for India; in 2017, the United States was its second largest export market (16% share) after the European Union (EU, 17%), and third largest import supplier (6%) after China (17%) and the EU (10%). U.S.-India foreign direct investment (FDI) is small, but growing. The Defense sales are momentous in bilateral trade. The Trump Administration views to bilateral trade balances as a pointer of the healthy trade relationship, that’s where the trade deficit with India has been criticized by USA for a range of “unfair” trading practices. Countering this view, India notes that the U.S. bilateral trade deficit dropped in 2018. The causes and consequences of trade deficits are debated.

NOTE: All figures are in millions of U.S. dollars on a nominal basis, not seasonally adjusted unless otherwise specified. Details may not equal totals due to rounding. Table reflects only those months for which there was trade.

| Month | Exports | Imports | Balance |

| January 2018 | 2,219.4 | 4,427.0 | -2,207.6 |

| February 2018 | 2,279.1 | 3,956.6 | -1,677.5 |

| March 2018 | 2,905.8 | 4,348.4 | -1,442.5 |

| April 2018 | 2,443.5 | 4,826.7 | -2,383.3 |

| May 2018 | 2,628.0 | 5,079.5 | -2,451.5 |

| June 2018 | 3,066.2 | 4,188.3 | -1,122.2 |

| July 2018 | 2,588.4 | 4,596.2 | -2,007.8 |

| August 2018 | 3,112.3 | 5,031.4 | -1,919.1 |

| September 2018 | 3,014.8 | 4,549.9 | -1,535.1 |

| October 2018 | 2,894.0 | 5,338.9 | -2,444.9 |

| November 2018 | 2,644.3 | 4,109.5 | -1,465.2 |

| December 2018 | 3,324.4 | 3,955.1 | -630.7 |

| TOTAL 2018 | 33,120.1 | 54,407.5 | -21,287.4 |

Tariff Issue

Bilateral stress has increased over each side’s tariff policies. These include the U.S. 25% steel and 10% aluminum tariffs under the national-security based “Section 232” law. India did not receive an initial exception like some trading partners, nor negotiate an alternative quota arrangement. India supplied less than 3% of U.S. steel and aluminum in 2017. India has delayed further imposing its planned retaliatory tariffs until May 2, 2019, in hopes of a bilateral resolution; these tariffs of 10% to 50% would target $241 million in U.S. goods such as nuts, apples, steel, and motorcycles. India also is challenging the U.S. tariff increases in the World Trade Organization (WTO). President Trump has called India “a very high-tariff nation” and criticized tariff imbalances, such as on motorcycles (which previously faced 100%, now 50%, Indian tariffs, compared to U.S. tariffs of 0% to 2.4%). India has high tariff rates, especially in agriculture. It can raise its applied rates to bound rates without violating its commitments under the WTO, causing uncertainty for U.S. exporters.

India’s tariff hikes include raising tariffs on cell phones from 0% originally to 15% to 20%, prompting the United States and others to question India’s compliance with the WTO Information Technology Agreement (ITA). The EU initiated WTO dispute settlement consultations, claiming that certain tariff hikes by India exceed bound rates. U.S. concerns over Indian market access include price controls on medical devices, and investment and other non-tariff barriers.

U.S. Generalized System of Preferences (GSP)

“…after intensive [bilateral] engagement…, I have determined that India has not assured the United States that it will provide equitable and reasonable access to the markets of India…”—President Trump’s GSP notification letter to Congress, March 4, 2019

“…India was able to offer a very meaningful way forward on almost all the US requests. In a few instances, specific US requests were not found reasonable and doable… in light of public welfare concerns reflective of India’s developing country status…”—Indian Ministry of Commerce statement, March 5, 2019

On March 4, 2019, President Trump notified Congress of his intent to terminate India’s GSP eligibility, which gives duty-free tariff treatment to certain U.S. imports from eligible developing countries to support their economic development. The review of India’s market access practices, as well as petitions by the U.S. medical device and dairy industry. India is GSP’s top beneficiary. In 2018, GSP represented 11% ($6.3 billion) of U.S. merchandise imports from India, such as chemicals, auto parts, and tableware. GSP removal would reinstate U.S. tariffs, which range from 1% to 7% on the top 15 GSP bilateral imports. India required extension of its eligibility, but since the President’s announcement, has downplayed the impact of the proposed change. India plans to treat retaliatory tariffs separately.

Current Negotiations and Agreements Bilateral Engagement

The United States and India have “serious” negotiations to tackle in steel and aluminum tariffs, India’s GSP status. Discussions consist of the government-to-government Strategic and Commercial Dialogue (S&CD) and Trade Policy Forum, and the private sector-based CEO Forum.

The United States and India do not have a bilateral free trade agreement (FTA). In October 2018, President Trump stated that India expressed interest in negotiating an FTA. Some India bystanders advocate for an FTA, while others question India’s willingness to open its markets.

The Past negotiations on a bilateral investment treaty are halted. India is party to negotiations on the Regional Comprehensive Economic Partnership (RCEP) with China and 15 other Asia-Pacific nations. Seven RCEP members (but not India) are among the 11 remaining parties of the proposed Trans-Pacific Partnership (TPP); they concluded a new trade agreement after President Trump ceased U.S. participation in the TPP. Among other issues, India has long sought to join the Asia-Pacific Economic Cooperation (APEC) group of the United States, China, and 19 other economies.

The United States stated that it welcomes India in APEC, if India is willing to make satisfactory economic reforms to join APEC. The WTO Differing U.S. and Indian visions on multilateral negotiations for the liberalize trade in the WTO.

The Trade Facilitation Agreement (TFA) was to remove customs obstructions; the first multilateral agreement concluded in over 20 years was entered into force in 2017 after India reversed its prior blocking of the TFA.

Conclusion

The problem of Indian tariffs being high has been raised from time to time. It is significant that India’s tariffs are within its bound rates under WTO commitments. India’s trade-weighted average tariffs are 7.6%, which is equivalent with the most open developing economies, and some developed economies. On developmental considerations, there may be a few tariff peaks, which is true for almost all economies.

India was to your liking a very significant acceptable parcel on the lines to be agreed.

BIBLIOGRAPHY

FOR EDUCATIONAL PURPOSE ONLY.

- https://fas.org/sgp/crs/row/IF10384.pdf

- http://www.mondaq.com/india/x/789050/international+trade+investment/USAChina+Trade+War+An+Overview

- https://www.census.gov/foreign-trade/balance/c5330.html

- https://www.google.com/search?q=US+and+India+international+trade&source=lnms&tbm=isch&sa=X&ved=0ahUKEwjilpyMw8DiAhUQf30KHQ4KBq0Q_AUIDygC&biw=1280&bih=689#imgrc=n6_0qLObEYHIHM: