By Yash Choudhary (ASC Solicitors & Advocate’s)

Introduction

The cross-border transaction in the globalised world has become a requisite element of our own economy, resulting in modification of tax system in accordance to the globalised economic norms. The domestic tax policies largely influence transaction with other countries, which has led to the appraisal of taxation system sporadically in order to assimilate the contemporary requirements.

There are two doctrines, which administrate the financial jurisdiction of taxation between two countries. These are;

- The source rule: – source rule holds that income should be taxed in the place of origin irrespective of the residential status of an individual.

- The residence rule: – residence rule assesses the tax on an individual based on their residence status.

Therefore, in a cross border trade; this will give rise to the conflict of these two separate regulations and bear taxes at both ends. If States decide to tax income on such unilateral basis, without any agreement with the other State, it will create an obstruction to trade and hinder globalization.

Defining Double Taxation

Double taxation refers to the phenomenon of taxing the same income twice. This occurs when the same income associated to an individual is treated as being accrued, arising or received in more than one country. DTAA or Double Taxation Avoidance Agreement is a treaty or agreement which permissible in terms of Article 253 of the Constitution of India, which helps to surmount such bewilderment by enacting, rules of taxation between Source and Residential country. Government of India can enter into agreement with a foreign government vide Entry 14 of the Union List regarding any matter provided Parliament verifies it. It is a universally accepted principle that no income should be taxed twice. Income Tax Act, 1961 serves to such principle by providing relief against double taxation under section 90 and section 91.

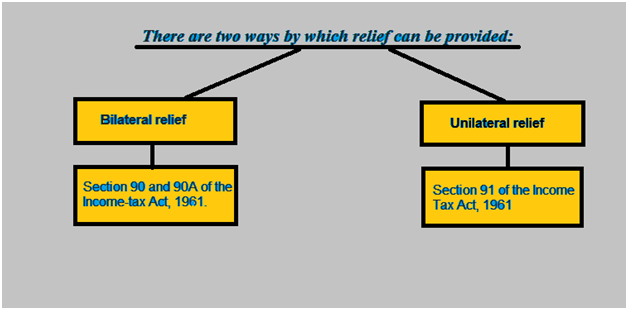

Types of Relief

Bilateral relief

When there is an agreement singed between two states to provide liberation against double taxation by mutual system to grant relief. In India, bilateral relief is provided under Section 90 and 90A of the Income-tax Act, 1961.

Bilateral agreements can be characterized as:

Exemption Method

Where two States have consented in relation to the income occurring at specified source and that income is taxable in both the countries. It should moreover be taxed in only one of them or that each of the two countries should tax only a particular specified portion of the income so that there is no overlapping.

Tax Credit Method

In relation to this kind of agreement, single taxability is not endowed with but some relief is provided. The assessee is given a deduction in the remainder in form of credit from the difference in amount, despite the fact that he is accountable to have his income taxed in both the countries.

Section 90A Of Income –Tax, 1961 Act states, Adoption by Central Government of agreement between specified associations for double taxation relief.

Unilateral relief

The

relief provided by residence country irrespective of any DTAA is available the

country concerned. The reason way this relief exists is because bilateral

agreements might not be adequate to convene all the cases. The Section 91 of

the Income Tax Act, 1961 provides such relief; where there is no relief available

Section 90 then Section 91 will prevail. Unilateral relief is only

available in respect to doubly taxed income that is part of income which is

included in assessee’s total income.

Section 91 of Income Tax Act, 1961 states:

- In any previous year, a person resident in India, has paid tax in any country with which India has no bilateral agreement under Section 90 for the relief or avoidance of double taxation in respect of his income which accrued or arose during that previous year under the law in force in that country, by deduction or otherwise, he shall be entitled to the deduction from the Indian Income Tax payable by him calculated on such doubly taxed income at this Indian Rate of Tax or the rate of the said country whichever is lower or at the Indian rate of tax, if both rates are equal.

- If in any previous year proves that in respect of

his income which accrued by him during that previous year in Pakistan he has

paid in that country, by deduction or otherwise, tax payable to the Government

under any law for the time being in force in that country relating to taxation

of agricultural income, he shall be entitled to a deduction from the Indian

income-tax payable by him—

- Of the amount of the tax paid in Pakistan under any law aforesaid on such income which is liable to tax under this Act also; or

- Of a sum calculated on that income at the Indian rate of tax; whichever is less.

- If any non-resident person is assessed on his share in the income of a registered firm assessed as resident in India in any previous year and such share includes any income accruing outside India during that previous year with a country with which there is no agreement under section 90 for the relief from double taxation. If he proves that income-tax has been remunerated by deduction or otherwise under the law in force in that country. He shall be entitled to a deduction from the Indian income-tax payable by him of a sum calculated on such doubly taxed income so included at the Indian rate of tax or the rate of tax of the said country, whichever is the lower, or at the Indian rate of tax if both the rates are equal.

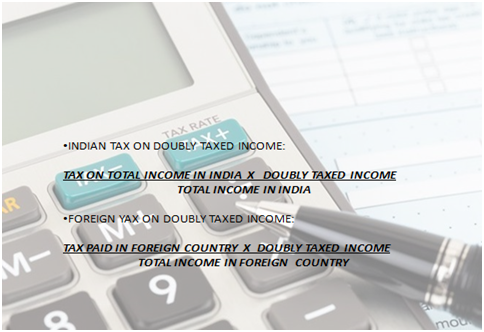

- Method explained with the help of the chart.

Necessity for DTAA

The necessitate for Double Taxation Avoidance Agreement (DTAA) started because of regulations in two countries regarding chargeability of income based on receipt and accretion, residential status etc. The DTAA eliminates or mitigates the occurrence of double taxation by sharing revenues arising out of international transactions by the two contracting states of the agreement. As there is no clear definition of income and taxability thereof, which is accepted internationally, an income may become liable to tax in two countries. In such a case, the possibilities are as under:

- The income is taxed only in one country.

- The income is exempt in both countries.

- The income in taxed in both countries, but credit for tax paid in one country is given against tax payable in other country.

If the two countries do not have DTAA then in such a case, the domestic law of the country will apply. In the case of India, the provisions of Section 91 of the Income Tax Act will apply.

Bibliography

- https://www.indiafilings.com/learn/double-taxation-relief/

- https://www.incometaxindia.gov.in/pages/international-taxation/dtaa.aspx

- https://www.startupdecisions.com.sg/singapore/taxes/india-singapore-double-tax-treaty/

- https://blog.ipleaders.in/reliefs-calculated-dtaa/

- https://www.indiantaxupdates.com/concept-of-double-taxation-relief-us-9090a91/

- https://www2.deloitte.com/content/dam/Deloitte/in/Documents/tax/Global%20Business%20Tax%20Alert/in-tax-gbt-delhi-bench-tribunal-rules-taxability-india-income-noexp.pdf

- https://en.vietnamplus.vn/government-approves-double-taxation-avoidance-pact-with-macau/137242.vnp

- https://www.relakhs.com/double-taxation-avoidance-agreement/

-

https://www.incometaxindia.gov.in/pages/acts/income-tax-act.aspx