Written & Design by Yash Choudhary (ASC Solicitors & Advocate’s)

FinTech Introduction

The expression “FinTech” is an abbreviation of the words “finance” and “technology”. It represents the technologies that are promising to challenge customary banking and financial companies.

According to Financial Stability Board (FSB), of the BIS, “FinTech is technologically enabled financial innovation that could result in new business models, applications, processes, or products with an associated material effect on financial markets and institutions and the provision of financial services”. This definition intend at encircling the extensive range of innovations in financial services enabled by technologies, regardless the type, size and regulatory status of the innovative firm. The broadness of the FSB definition is useful when assessing and anticipating the rapid development of the financial system and financial institutions, and the associated risks and opportunities.

Financial institutions are looking forward to increase their acquaintance in relation to technological innovation, through partnerships with tech companies and by investing in or acquiring such companies.

FinTech innovations, products and technology

FinTech is a young sector but is growing rapidly, fueled by a large market foundation, an innovation-driven startup landscape and friendly government policies and regulations. Several startups populate this emerging and dynamic sector, while both traditional banking institutions and non-banking financial companies (NBFCs) are catching up. This new disruption in the banking and financial services sector has had a wide-ranging impact.

In India, FinTech has the prospective to present workable resolutions to the difficulties faced by the traditional financial institutions such as low penetration, scarce credit history and cash driven transaction economy. The FinTech services firms are currently redefining the way companies and consumers conduct transactions on a daily basis.

The Indian FinTech industry grew 282% between 2013 and 2014, and reached USD 450 million in 2015. At present around 400 FinTech companies are operating in India and their investments are expected to grow by 170% by 2020. The Indian FinTech software market is forecasted to touch USD 2.4 billion by 2020 from a current USD 1.2 billion, as per NASSCOM. The transaction value for the Indian FinTech sector is estimated to be approximately USD 33 billion in 2016 and is forecasted to reach USD 73 billion in 2020.

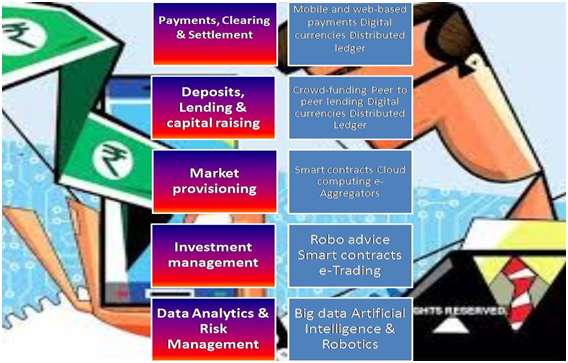

Classification of fintech market

A straightforward classification of some of FinTech innovations can be grouped according to the areas of financial market activities with help of this chart:

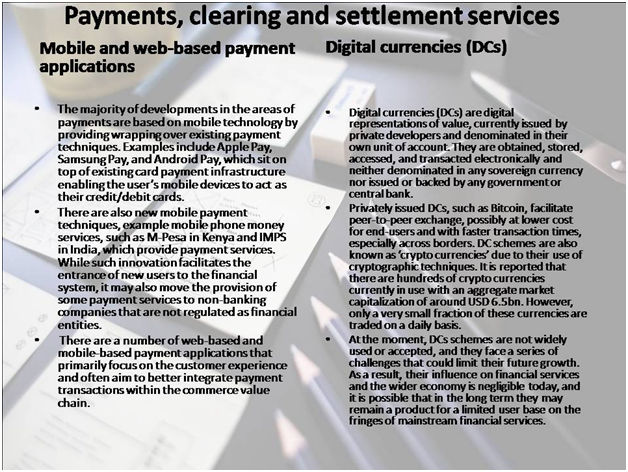

Payments, clearing and settlement services

illustrated in infographic,

Distributed ledger technologies (DLT)

DLT provides an inclusive and secure transaction records, updated and verified by users, removing the need for a central authority. These technologies allow for direct peer-to-peer transactions, which might offer benefits, in terms of efficiency and security, over presented technological solutions.

The impulsion behind the growth and adoption of distributed ledger technology are its prospective benefits. The major benefits are reduced cost; faster settlement time; reduction in counterparty risk; reduced need for third party intermediation; reduced collateral demand and latency; better fraud prevention; simplification of reporting, data collection, and systemic risk monitoring and increased privacy.

Block chain Technology

Block chain is a distributed ledger in which transactions (e.g. involving digital currencies or securities) are stored as blocks (groups of transactions that are performed around the same point in time) on computers that are connected to the network. The ledger grows as the chain of blocks increases in size. Each new block of transactions has to be verified by the network before it can be added to the chain. This means that each computer connected to the network has full information about the transactions in the network. Block chain potentially has far-reaching implications for the financial sector, and this is prompting more and more banks, insurers and other financial institutions to invest in research into potential applications of this technology.

Frequently cited benefits of Block chain are its transparency, security and the fact that transactions are logged in the network. Some of the disadvantages currently include the lack of coordination and the scalability of this technology. One of the best-known applications of Block chain technology at the present time is bitcoin. Transactions in this virtual currency are largely unidentified. This creates ethical risks for financial institutions dealing with users of this currency, because they are unable to entirely verify their identity.

It is pragmatic that market participants in other securities markets are investigating the usage of Blockchain or Distributed Database technology to provide various services such as clearing and settlement, trading, etc., therefore, there is a necessitate to comprehend the advantages, risks and disputes which such developments may facade.

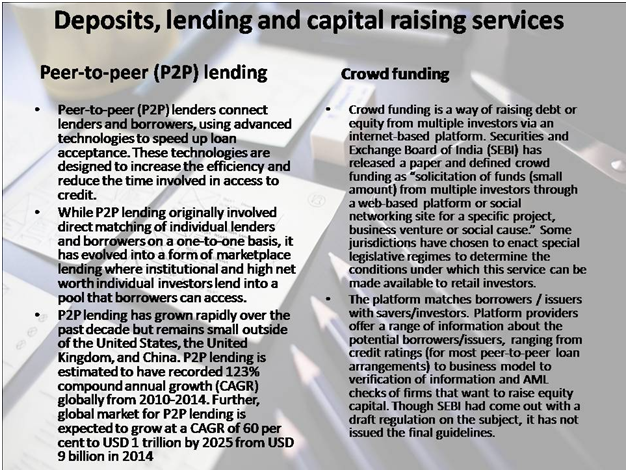

Deposits, lending and capital raising services

Unconventional forms of lending and capital are growing eminence, underlying changing the market dynamics of traditional lenders and influencing the role of traditional intermediaries. A few examples of the products offered by FinTechs are as under: “infographic”

Market provisioning services

Progresses in computing power are facilitating quicker and cheaper proviso of information and services to the market. A few of these innovations are: “infographic form”

Investment management services

The mechanized systems have the potential to transform the business of investment management. Few frequently used applications in investment management services are:

Robo advice

“Robo-advice” is the proviso of financial guidance by automatic, money supervision providers resulting in disintermediation of human advisors and reducing costs. This can give investor more choice, principally for low and middle income investors who do not have access to the wealth management divisions of the banks.

Robo advisors are regulated just like independent advisors who set up offices and meet clients on a regular basis in USA. They typically register with the U.S. Securities and Exchange Commission and are deemed ‘fiduciaries’ that must put their clients’ interests above their own.

E-Trading

Electronic trading has become an important part of the market, especially in fixed income markets. It has enabled a pickup of automated trading. It could also lead market structures to evolve from over-the-counter to a structure where all-to-all transactions can take place. The development of e-trading platforms contributes to improving the efficiency of market orders and to reducing average trading costs.

Regulatory proposals:

Global experiences on regulatory

FinTech have emerged as a potentially conversing force in the financial markets. A fresh Financial Stability Board (FSB) study highlighted some of the prospective benefits of FinTech, including efficiency improvements, risk reduction and greater financial inclusion. The study also recognized some of the key challenges associated with FinTech, such as difficulty of regulating an evolving technology with different use cases, monitoring activity outside the regulated sector, and identifying and monitoring new risks arising from the technology.

The expansions of digitization in banking present regulatory and supervisory challenges for several reasons.

- First, financial technology is increasing the channels for provision of finance, both from banks and non-banks (e.g. platform-based lending).

- Second, technological innovation is affecting existing bank business models, which in turn could undermine their overall business strategies.

- Third, the rise of FinTech may lead to fundamentally different bank risk profiles.

In this regard, best practices and principles for the management and supervision of risks arising from financial technology are much needed.

Financial innovation has become a central point of concentration for regulators, and some jurisdictions have decided to take a more active approach in facilitating this innovation. To do this, they have put in place a variety of regulatory and supervisory initiatives such as regulatory sandboxes, innovation hubs or teams, innovation incubators or accelerators, etc.

Regulatory uncertainty neighboring FinTech could potentially obstruct its development. As a result, international standard setting bodies Basel Committee on Banking Supervision (BCBS), Financial Stability Board (FSB), and World Bank Group including regulatory authorities of different jurisdictions are taking steps to actively monitor FinTech developments both domestically and in cooperation with international organizations.

Emerging Regulatory and Supervisory issues in India

Regulatory and Supervisory response in India

FinTech has considerable connotations on the intact financial system in India. The multiplicity of firms and a mosaic of business models obscure the classification of the various types of activities, products and transactions covered under the FinTech spectrum.

Though the western world has been using the term ‘FinTech’ for some time, it has only recently become an exhortation in India. FinTech has, since quite some time, gathered momentum in the country. However, as of now, the FinTech risks are being looked at more in terms of what is associated with the traditional IT systems, such as cyber-security risks.

While the IT related risks are no doubt multiplying manifold under FinTech, the whole range of issues under the FinTech, particularly regulatory concern, have to be responded to on priority. It is, therefore, essential to inspect these issues and outline an appropriate regulatory strategy. However, FinTech treads across several activities that are within the scope of different financial sector regulators.

RBI issued a consultation paper on P2P lending in April 2016. Some of the issues raised in the consultation paper are as under:

- Regulations may also be perceived as too stringent, thus stifling the growth of an innovative, efficient and accessible avenue for borrowers who either do not have access to formal financial channels or are denied loans by them.

- The market for P2P lending is currently in a nascent stage and they neither pose an immediate systemic risk nor any significant impact on monetary policy transmission mechanism.

- In its nascent stage, this industry has the potential to disrupt the financial sector and throw surprises. A sound regulatory framework will prevent such surprises.

- P2P lending promotes alternative forms of finance, where formal finance is unable to reach and also has the potential to soften the lending rates as a P2P Lending result of lower operational costs and enhanced competition with the traditional lending channels.

- If the sector is left unregulated altogether, there is the risk of unhealthy practices being adopted by one or more players, which may have deleterious consequences.

It has been proposed in the consultation paper to bring the P2P lending platforms under the purview of Reserve Bank’s regulation by notifying P2P platforms as NBFCs.

Monitoring framework for new technologies / proposals:

The RBI as regulator and supervisor of payment systems has been performing the role as the catalyst / facilitator for innovations in payment systems. The Payment and Settlement System Vision – 2018 also covers this aspect appropriately under the Strategic Initiatives, Responsive Regulation and Effective Oversight. In array to guarantee that regulations keep velocity with the developments in technology impacting the payment space, the global developments in technology such as distributed ledgers, blockchain, etc.

Further, the payments eco-system is vigorously evolving with the progressions and innovations particularly in the area of FinTechs. To showcase their models to the industry, particularly in the areas of interest to payment systems and services, the Reserve Bank has organized an innovation contest through the Institute for Development and Research in Banking Technology (IDRBT). Learning’s from such interfaces will also be used as inputs for policy adaptations. RBI has taken various initiatives in the technology-enabled banking space as:

- Issued in-principle approvals for Payments Banks, of which some have since been licensed

- Allowed entry of non-banks in the payments space both as payment system operators and technology service providers

- Introduced Bharat Bill Payments System (BBPS)

- Published a consultative paper on Card Payment Infrastructure

- Issued a consultation on Peer to Peer (P2P) lending

- Issued Directions on Account Aggregators

- Authorised payment solutions provided by NPCI such as NACH, AEPS, IMPS, Unified Payment Interface (UPI)

- Given in-principle approval for National electronic toll collection project.

- Set up the framework for the electronic Trade Receivables Discounting System (TReDS) to improve flow of funds to MSMEs.

Regulation

FinTech powered business should ideally be undertaken by only regulated entities, e.g. banks and regulated payment system providers,

- The forms of business which can be undertaken by, say, a banking company are specified in section 6 of the Banking Regulation Act, 1949 and no banking company can engage in any form of business other than those referred to in that section. This provision however also enables a banking company to do such other things which are incidental or conducive for the promotion or advancement of its business. Banking companies can therefore form subsidiaries for undertaking any business which supports their main business. Subsidiaries can also be formed for undertaking such other business which Reserve Bank may, with the approval of the Central Government, consider being conducive to spread banking in India or to be otherwise useful for necessary in the public interest [section 19(c), BR Act]. These provisions give room for banking companies to undertake focused innovative FinTech business relevant to their operations, via a dedicated subsidiary, while remaining within the legal framework of the Banking Regulation Act. However, as FinTech innovations are typically multiple-use, with significant applications beyond financial regulation, it may be inefficient and counterproductive to restrict core FinTech activities to only those entities and applications which are covered under financial regulation/supervision.

- The Payment and Settlement Systems Act, 2007 provides for authorization, regulation and supervision of payments systems by Reserve Bank. A payment system is defined in that Act as a system that enables payment to be effected between a payer and a beneficiary, involving clearing, payment or settlement service or all of them, but does not include a stock exchange or clearing corporation set up under a stock exchange. It is further stated by way of an explanation that a “payment system” includes the systems enabling credit card operations, debit card operations, smart card operations, money transfer operations or similar operations. As the bulk of FinTech innovations do not amount to ‘payment system’ as defined under that Act, they will not fall under its regulatory framework.

- Section 35A of the Banking Regulation Act empowers the Reserve Bank to issue directions to banking companies in public interest and in the interest of banking polices, etc. Reserve Bank is also empowered under section 36 of the BR Act to caution or prohibit banking companies generally and generally to give advices to banking companies. As regards payment systems, section 17 of the Payment and Settlement Systems Act gives the RBI the power to issue directions to payment systems and systems participants. It may be possible for the Reserve Bank to invoke these provisions in case FinTech innovations used by these regulated entities require RBI intervention.

- The Watal Committee Report recommends that the regulator should enable a formal framework for a regulatory sandbox. A regulatory sandbox can be used to carve out a safe and conducive space to experiment with FinTech solutions, where the consequences of failure can be contained.

- IDRBT, an institute established by the Reserve Bank of India exclusively for research and development in the area of banking technology, has been working closely with banks and technology companies. The institute, at the instance of RBI, organized a payment system innovation contest in the year 2016. The institute has facilities for testing mobile apps, which are being used by banks.

- In view of IDRBT’s unique positioning as a RBI established institute, and its expertise and experience, it is felt that IDRBT is well placed to operate a regulatory sandbox, in collaboration with RBI, for enabling innovators to experiment with their solutions for eventual adoption. The Institute may continue to interact with RBI, banks, solution providers regarding testing of new products and services and over a period of time upgrade its infrastructure and skill sets to provide a full-fledged regulatory sandbox environment.

Looking with the reflective revolutionizing that FinTech is bringing to the banking and financial sectors, regulators need to take care to avoid two downsides. The first is overprotecting incumbents by erecting barriers to entry for newcomers. Doing so would discourage financial innovation and choke competition in the financial sector. The second drawback is unduly favour newcomers by regulating them less stringent than incumbents, in the name of fostering competition.

Conclusion

The general regulatory principles can be summarized. The first should be to uphold a neutral stand with view to technological advances. Regulations should promote healthy competition between players, despite of whether they offer conservative approaches or use new technological solutions. We need to evade unnecessary hindrances to growth for new participants.

The second principle is that we have nurture sets of rules, inter-operability, rather than treating players differently according to their characteristics, an approach that would artificially section to the market and hence limit competition and lastly, that regulators must also act in the interests of users, protecting them in a changing environment that can facade new, unanticipated risks.

Regulators have a difficult role to play as their decisions have both a direct and indirect impact on competition between current firms and newcomers. They have to provide a level playing field for all participants, but at the same time promote an innovative, secure and competitive financial market.

Bibliography

The Article is only for educational purpose.

- https://www.india-briefing.com/news/future-fintech-india-opportunities-challenges-12477.html/

- https://yourstory.com/2019/02/india-fintech-trends-paytm-phonepe-3uqde49c56

- https://economictimes.indiatimes.com/small-biz/startups/newsbuzz/indias-fintech-future-looks-bright-but-it-needs-to-find-its-raison-dtre/articleshow/67986757.cms?from=mdr

- https://www.pwc.in/consulting/financial-services/fintech/fintech-insights/towards-a-more-supportive-regulatory-regime.html

- https://www.google.com/search?biw=1280&bih=640&tbm=isch&sa=1&ei=Dw3VXIKqOoXZz7sP46qyiAs&q=global+fintech+&oq=global+fintech+&gs_l=img.3..0l2j0i30j0i24l7.115187.122171..123752…0.0..0.207.1697.0j10j2……0….1..gws-wiz-img…….0i67j0i5i30j0i7i30j0i8i7i30.WObZg57fpk0#imgrc=fAw-1RTRLtV53M:

- M/s Backwaters Tech Pvt. Ltd., Faircent Technologies India and Deutsche Bank and Bill & Melinda Gates Foundation

- KPMG-The pulse of Fin Tech- https://home.kpmg.com/xx/en/home/media/press-releases/2016/03/kpmg-and-cb-insights.html

- Drawing on a categorization from WEF, The Future of Financial Services, Final Report, June 2015

- Committee on Payments and Market Infrastructures, “Digital Currencies,” November 2015.

- Fintech: Describing the Landscape and a Framework or Analysis by STANDING COMMITTEE ON ASSESSMENT OF VULNERABILITIES of FSB-March 2016

- In the US, new P2P lending was USD 12 billion in 2014, (USD 7 billion in unsecured consumer loans and USD 5 billion in small business loans). In the UK, P2P platforms originated about EUR 2.7 billion in 2015. Source: Morgan Stanley (2015) “Global Marketplace Lending: Disruptive Innovation in Financials”. Source-Bloomberg

- Fintech: Describing the Landscape and a Framework or Analysis by STANDING COMMITTEE ON ASSESSMENT OF VULNERABILITIES of FSB-March 2016

- CGFS, Fixed Income Market Liquidity, January 2016

- The Pulse of Fintech, KPMG, 2016

- India emerging a hub for Fintech start-ups, Business Standard, http://www.business-standard.com/article/companies/india-emerging-a-hub-forFintech-start-ups-116051700397_1.html, 17 May 2016

- India emerging a hub for fintech start-ups, Business Standard website, http://www.businessstandard.com/article/companies/india-emerging-a-hub-for-fintech-start-ups- 116051700397_1.html, accessed on 25 May 2016.

- Statista website, https://www.statista.com/outlook/295/119/fintech/india, accessed on 25 May 2016, 17 May 2016

- Application of Blockchain Technology in Indian banking and financial sector by IDRBT-January 2017

- http://www.fsb.org/wp-content/uploads/Chatham-House-The-Banking-Revolution-Conference.pdf

- http://pubdocs.worldbank.org/en/877721478111918039/breakout-DigiFinance-McConaghy-Fin Tech.pdf

- https://www.afm.nl/nl-nl/professionals/nieuws/2016/jun/innovation-hub

- http://www.bis.org/review/r161111c.htm

- http://www.bis.org/review/r160823d.pdf

https://www.rbi.org.in/Scripts/PublicationReportDetails.aspx?UrlPage=&ID=892#3