By Yash Choudhary (ASC Solicitor’s & Advocate’s)

Venture Capital is a type of rock sponsoring in which investment are made in the initial stage of business enterprises. It is investment in small start-up ventures, holding high risk and potential development in future. The Venture Capital Investors (VC) are commonly put their funds in new ideas, innovations and having potential of high growth with natural uncertainties.

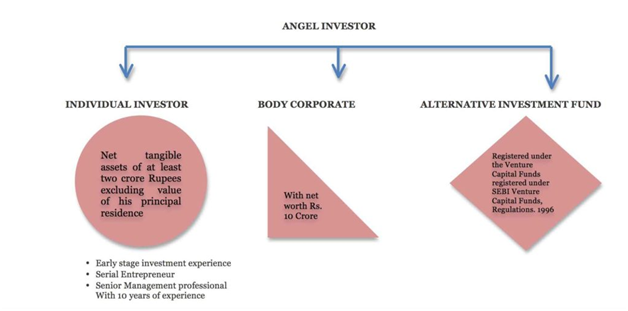

The “Angel Investors” are wealthy Individuals retired from MNCs with abundance of funds to invest innovative ideas. VC Investors are sometime referred as “Angel Investors”. They are a grouping of investors, who have pooled their money in array of sources. They act as an angel for start-up. Since start-ups with new innovative ideas are not often supported by the Banks, for not having any track records of business. Start-ups are facing harsh time to finance their ideas and innovations.

K.B. Chandrasekhar Committee on Venture Capital;

“With a view to promote innovations, enterprise and conversion of scientific technology and knowledge-based ideas into commercial production, it is very important to promote venture capital activities in India. A flourishing venture capital industry in India will fill the gap between the capital requirements of technology and knowledge-based start-up enterprises and funds available from traditional institutional lenders such as the banks. The gap exists because such start-ups are necessarily based on intangible human assets and technology enabled mission, often with a hope of changing world. Since they do not have physical assets and low risk-based projects and hence they are not favourite to banks and financial institutions.”

This shows the intent of the Government of India has shown to promote Venture Capital Funding’s.

REGULATION OF FOREIGN VENTURE CAPITAL INVESTORS

The Foreign Venture Capital Investor or FVCI is regulated under;

SEBI – SECURITY EXCHANGE BOARD OF INDIA

SEBI (Venture Capital Funds) Regulations, 1996, VC’s are considered to be an Investor Class under these regulations.

Foreign Venture Capital Investor (FVCI) has been defined as;

“To mean an investor incorporated and established outside India, is registered under these Regulations and proposes to make investment in accordance with these regulations.”

ELIGIBILITY: to be recorded under SEBI (FCVI) Regulations, aspirant can be Pension Fund, Mutual Fund, Investment Trust, Investment Company, Investment Partnership, Asset Management Company, Endowment Fund, University Fund, Charitable Institution or any other investment vehicle established or incorporated outside India.

CONDITIONS OF INVESTMENT; Regulation 11 of SEBI (Foreign Venture Capital Investor) Regulations, 2000 provides following regulations to be followed by all FVCI;

(a) FVCI should disclose to SEBI its investment strategies;

(b) While it can invest its total funds committed in one Venture Capital fund, it shall however not invest more than 25% of funds committed to investment in India in one Venture Capital Undertaking;

(c) It shall make investments in Venture Capital Undertaking as follows;

(i) At least 66.67% of investible funds shall be invested in unlisted equity shares or equity linked instruments;

(ii) Not more than 33. 33% of the investible funds may be invested by way of;

-Subscription of initial public offer by Venture Capital Undertaking, whose share are proposed to be listed and having lock-up period of one year;

-Debt or debt instruments of Venture Capital Undertaking in which Venture Capital Investor has already made investment in Equity Shares;

-Preferential allotment of shares of listed entity subject to lock-in period of one year;

-Equity or equity linked instruments of s financially weak company or sick industrial company whose shares are listed;

SPVs created for the purpose of facilitating and promoting investment in accordance with these regulations.

(d) It shall disclose the duration or life cycle of the investments.

RESERVE BANK OF INDIA;

The investment was categorized by FEMA, 1999 under Venture capital Investors in India as Capital Account Transactions and are regulated by Notification No. 20/2000-RB dated 3rd May, 2000 Foreign Exchange Management (Transfer or Issue of Security by a Person Resident outside India) Regulation, 2000.

The POLICY, 2016; FOREIGN VENTURE CAPITAL INVESTOR is defined as “Foreign Venture Capital Investor (FVCI) means an investor incorporated and established outside India, which is registered under SEBI (Venture Capital Investor) Regulations, 2000 and proposes to make investment in accordance with these regulations.”

MODE OF INVESTMENT BY FVCIs;

FVCIs under Schedule I of Inbound Regulations;

VC’s are permitted to invest under FDI Scheme, as non-resident entities in other company’s subject to FDI Norms and provisions of FEMA, 1999.

A FCVI has to decide upfront while investing into any Indian Company, whether the investment is under FDI Scheme or FCVI Scheme and report accordingly.

Under FDI Route all terms and conditions applicable to foreign direct investment as specified under Schedule I of Inbound Regulations will be applicable to FCVIs investment.

FVCIs under Schedule VI of Inbound Regulations;

The Schedule VI of Inbound Regulations, a FVCI (SEBI registered) may contribute up to 100% of the Capital of an Indian Venture Capital Undertaking or Category I- Alternative Investment Fund registered under SEBI (Alternative Investment Fund) Regulations, 2012 and may also setup a domestic Asset Management Company to manage the fund. Such investments are also regulated by applicable FEMA, 1999 and FDI Policy, 2016.

INDIAN VENTURE CAPITAL FUND; is classified as a fund established as a Trust, a Company including a Body Corporate and registered under the Securities and Exchange Board of India (venture Capital Fund) Regulations, 1996, which has a dedicated pool of capital raised in a manner specified in the said regulations and which invests in Venture Capital Undertakings in accordance with these regulations.

INVESTMENT BY FVCIs;

- Under Automatic Route up to 100% of the Capital of Indian company engaged in any activity mentioned in Schedule VI of Notification No. 20/200-RB dated 3rdMay, 2000, including start-ups irrespective of sector in which it is engaged under the Automatic Route;

- A SEBI Registered FVCI can invest in domestic venture capital fund registered under SEBI (Venture Capital Fund) Regulations, 1996 or a Category-I Alternative Investment Fund registered under SEBI (Alternative Investment Fund) Regulations, 2012. Such investment shall be regulated by applicable provisions of FEMA, 1999 and FDI Policy, 2016 including sectoral caps as applicable.

- The venture can be made in equities or debts instruments issued by the Company (including start-ups and if a start-up is organised as Partnership firm or LLP, the investment can be made in the Capital or through any profit sharing arrangement).

- Units issued by VCF or by Category-I AIF either trough purchase by private arrangement either from issuer of the security or on a recognised stock exchange. The purchase can be at the time of Initial Public Offer or Private Placement of Securities or by way of purchase from third parties through Stock Exchanges.

FCVIs do not have to follow pricing guidelines as prescribed under FDI Policy.

MODE OF INVESTMENT;

Regulation 8 of SEBI (Foreign Venture Capital Investor) Regulations, 1996 provides a prerequisite that an FCVI is need to enter into pact with a Designated Bank for the function of opening a Non-Resident or Foreign Currency Account. The name, account number and address of the Designated Bank shall be provided, while getting registration according to regulations of SEBI (Foreign Venture Capital Investor) Regulations, 1996. All investment shall be routed through the mentioned and opened bank account with designated and reported bank.

Bibliography

For educational use only

- https://www.google.com/search?q=angel+investors+and+regulations&tbm=isch&source=iu&ictx=1&fir=MCqvOQlkTILb9M%253A%252Cnrp-2yJP9BM3PM%252C_&vet=1&usg=AI4_-kQ79faoIrHJ2LuWrXGGrloqhMMz1w&sa=X&ved=2ahUKEwiw95WGwZjiAhVenI8KHR8FChgQ9QEwAHoECA0QBg&biw=1280&bih=689#imgrc=MCqvOQlkTILb9M:

- https://taxguru.in/rbi/foreign-venture-capital-investors-related-regulations.html